5G roll-out is in full swing. 144 5G networks have been launched with 90 more expected in 2021. Over 200 5G devices are now on the market and 5G is expected to reach 1 in 5 people by the end of 2021. The 5G network is split broadly into the sub-6 GHz and mmWave spectrums. The vast majority of the deployment to date has been in the sub-6 GHz bands with the extent of infrastructure upgrades ranging from minor software changes to moderate unit upgrades. Whilst the sub-6 GHz bands are certainly vital to 5G, mmWave is where many of the wonderous vertical applications touted by operators are made possible. The super high download rates and super low latency help enable technologies such as autonomous vehicles, augmented reality, game streaming, and much more.

mmWave also comes with significant challenges; many will be aware that it has poor signal propagation, potentially being blocked by walls, windows, and even the mobile user’s hands. But another key challenge is the dielectric losses experienced in materials utilized throughout the infrastructure and mobile devices. This jump in frequency up to bands with 28 GHz and above also creates significant signal losses in materials used for the antennas, advanced electronics packaging, and many more areas. The IDTechEx report “Low-loss Materials for 5G 2021-2031” outlines the key material challenges as the 5G deployment continues in both the sub-6 GHz and mmWave bands, benchmarks the various material options, considers the players active in this field, and forecasts granular market breakdowns for these materials in infrastructure, mobile devices and customer premises equipment (CPE).

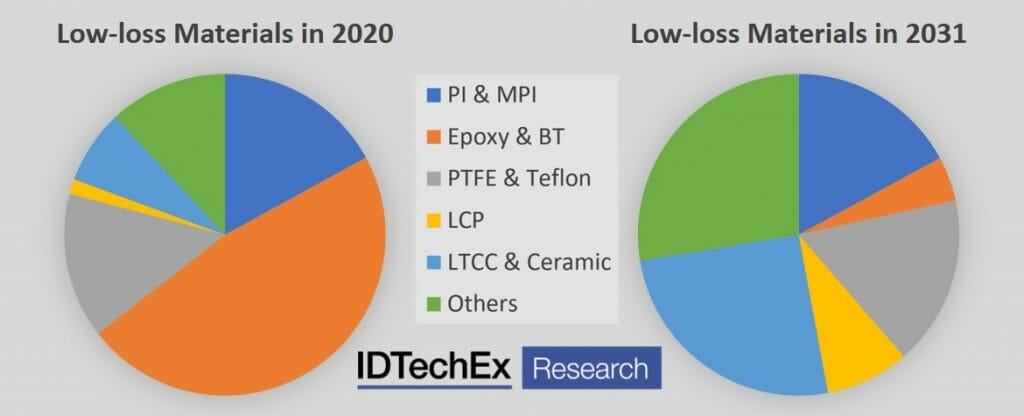

Materials used in future 5G networks will be different and more diverse. Source: IDTechEx report “Low-loss Materials for 5G 2021-2031”

The emphasis on low-loss materials in 5G has already started to take effect with Apple transitioning back to LCP (liquid crystal polymer) in the iPhone 12, partly for its low-loss properties, and rumors are circulating around large mmWave antenna orders being shared between companies to keep up with demand for the iPhone 13. We are also seeing increased moves from big materials players like Solvay advertising their PTFE (polytetrafluoroethylene), LCP and PPS (polyphenylene sulfide) options, SABIC expanding their production of low-loss PPE (polyphenylene ether) resin by 10-fold, and large acquisitions like DuPont acquiring Laird, both players active in this space.

As 5G deployment continues we can expect to see many more 5G mobile devices and much more mmWave utilization, especially later into this decade. Due to the poor signal propagation at high frequency, the mmWave network will be densely packed with infrastructure, combine this with the need for low-loss materials and we see an extremely large market for options such as PTFE, LCP, PPE, ceramics, hydrocarbons, glasses and more as we transition away from the legacy BT-epoxy (bismaleimide-triazine) based materials.

Aside from the low-loss material challenges, there are a host of issues relating to the extra heat generated by 5G devices and the materials solutions to solve them, IDTechEx has a report dedicated to this topic, “Thermal Management for 5G”, which covers semiconductor choices, die-attach technologies and “Thermal Interface Materials”. Additionally, there is a large number of technologies and players in the 5G space covered by the report “5G Technology, Market and Forecasts 2020-2030”.

For more information on the low-loss 5G report, please visit www.IDTechEx.com/LowLossMats, or for the full portfolio of 5G related research available from IDTechEx please visit www.IDTechEx.com/Research/5G.