Magnetic materials are key to producing electric vehicles. Many of the electric vehicles on the market use kilograms of magnetic materials to drive their electric motors. In fact, over 80% of electric cars sold globally utilized permanent magnet-based motors in 2019. These magnets are typically made with rare-earth materials such as neodymium and dysprosium, which have a very geographically constrained supply chain. China accounts for the vast majority of rare-earth production worldwide and this has, in the past, led to huge price volatility. In 2011, after China restricted its exports of rare-earths, the price of neodymium and dysprosium rose by approximately 750% and 2000% respectively.

While these prices have settled, rare-earths also present environmental concerns. The ores that rare-earths are extracted from are often laced with radioactive materials such as thorium. Separating the materials requires huge amounts of carcinogenic compounds like sulphate, ammonia and hydrochloric acid. Processing 1 tonne of rare-earths can produce up to 2000 tonnes of toxic waste.

Vehicle manufacturers are aware of these issues and many have made statements about either the elimination or reduction of rare-earths in their electric motors. Renault’s Zoe has utilized a wound rotor configuration to replace magnets with copper windings, BMW’s new 5th generation drivetrain has eliminated rare-earths and Audi has opted for an aluminium rotor induction motor for the e-tron. A variety of companies, including Bentley are also investigating switched reluctance motors for EV applications which require no magnets or copper in their rotors.

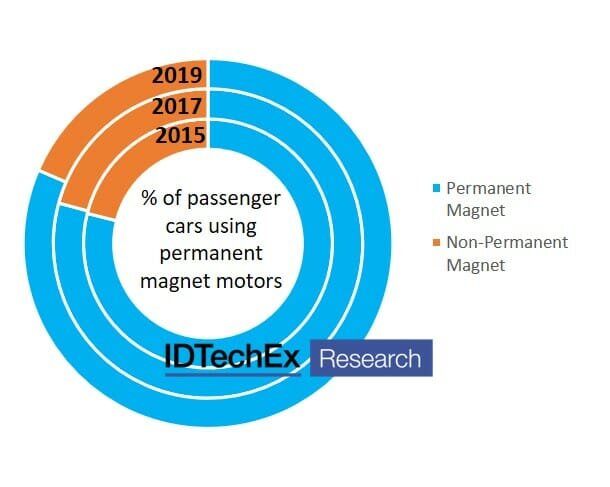

However, despite these trends, the new IDTechEx report “Materials for Electric Vehicles 2020-2030” finds that in recent years, there has been an increased shift towards more permanent magnet-based motors: 2019 saw this increase to 82% compared to 79% in 2015. Permanent magnet motors typically have better efficiency during normal driving conditions than their alternatives, this in turn can result in improved driving range. For this reason, we have seen Tesla transition from using copper induction motors in the Model S and X to using a permanent magnet motor in the Model 3 and Y (although dual motor variants use an ACIM on the front for a performance boost). Additionally, the Chinese electric vehicle market is the largest in the world and due to their control of the rare-earth supply, most Chinese vehicle models utilize permanent magnet motors.

The percentage of electric and plug-in hybrid cars using permanent-magnet based motors has been rising in recent years. Source: IDTechEx, “Materials for Electric Vehicles 2020-2030”

Whilst there has been much publicity and drive towards rare-earth reduction, in practice we are seeing an increase in the number of permanent magnet motors. However, these motors are using less magnetic material in total and OEMs such as Nissan and Honda have reduced or eliminated the heavy rare-earth components like dysprosium. Despite the potential reduction per vehicle of materials like neodymium, the overall increase in the global EV market will lead to an overall increase in the demand for rare-earth materials.

For more information, IDTechEx has provided analysis and forecasts for over 30 materials essential in the construction of electric vehicle traction motors, battery cells and battery packs in the latest report: “Materials for Electric Vehicles 2020-2030”.

IDTechEx analyzes adoption of electric vehicles, battery trends and demand across more than 100 different mobility sectors. This is summarized in a master electric vehicle report, found at www.IDTechEx.com/EV. Further in depth analysis can be found in the full portfolio of electric vehicle research available at www.IDTechEx.com/research/EV.

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact [email protected] or visit www.IDTechEx.com.