3QFY19E preview—saving grace. RIL’s operational hedging, weaker Rupee, reversal of forex

loss and higher other income, may keep 15-quarter streak of rising standalone profits intact. OMCs’ dismal results expected due to large adventitious/inventory loss may have a silver lining of higher underlying margins. Lower crude realizations for upstream will be offset by higher gas price, weaker Rupee and IOCL’s dividends. GAIL’s exposure to volatility in the US LNG economics may come to the fore, while PLNG’s results may be a tad weaker due to lower volumes and higher fuel cost. Higher unit margins may boost CGDs, even as volume growth slows down a bit.

RIL: hedging policies, weaker Rupee and forex gains to offset lower underlying refining margins

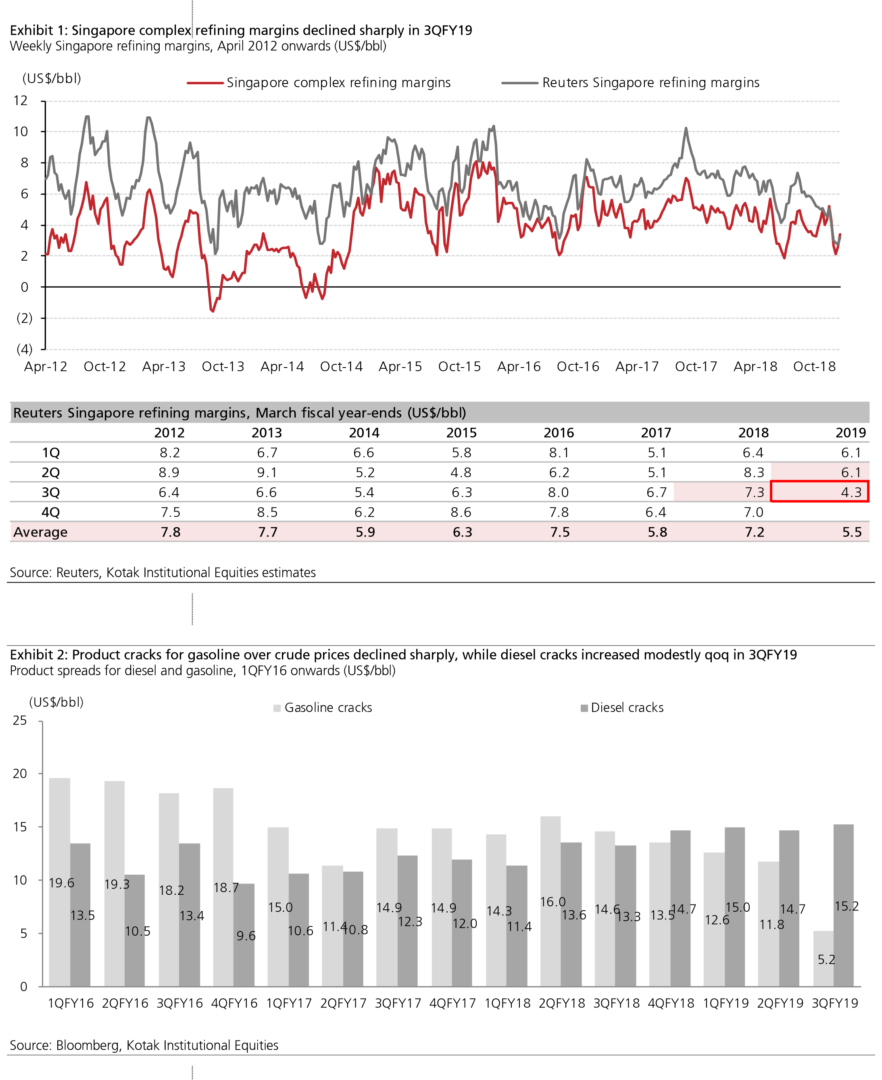

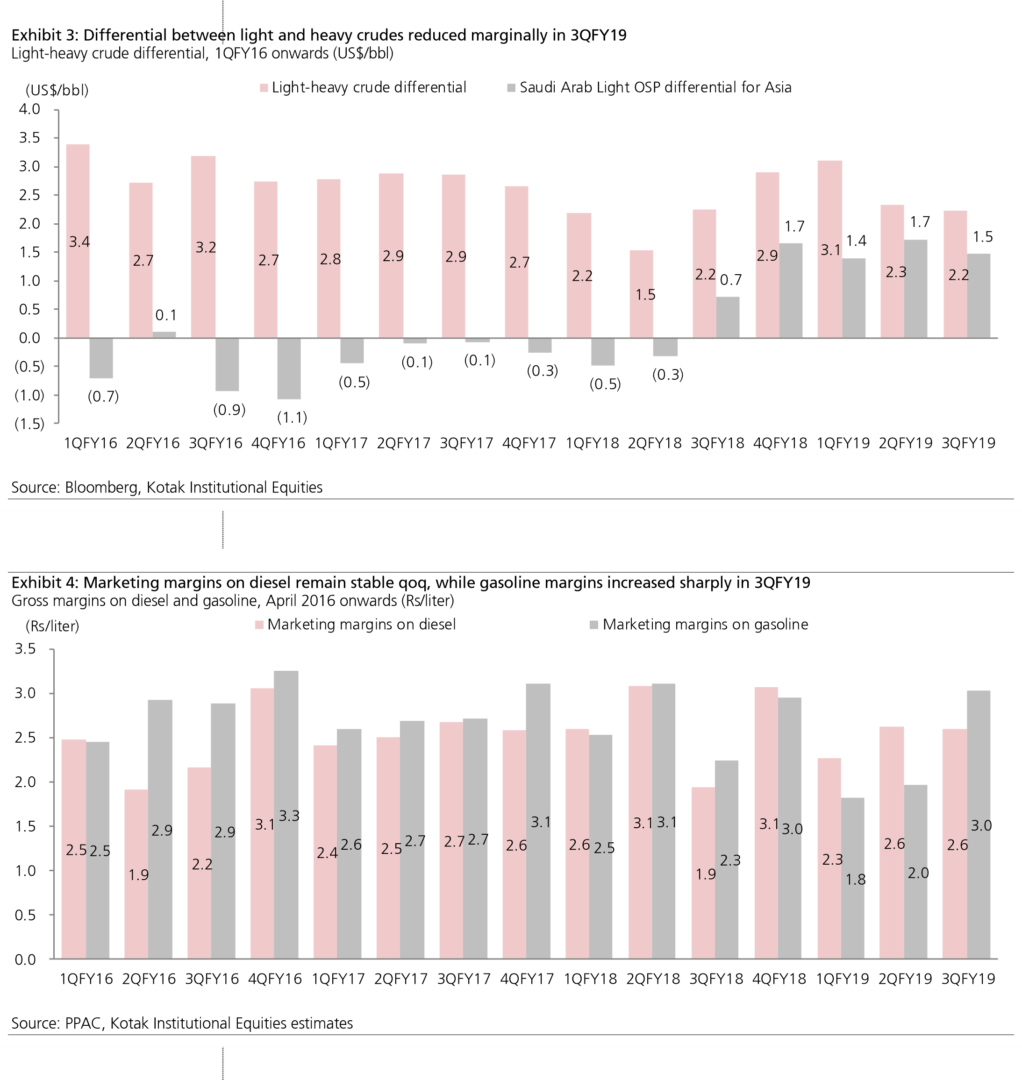

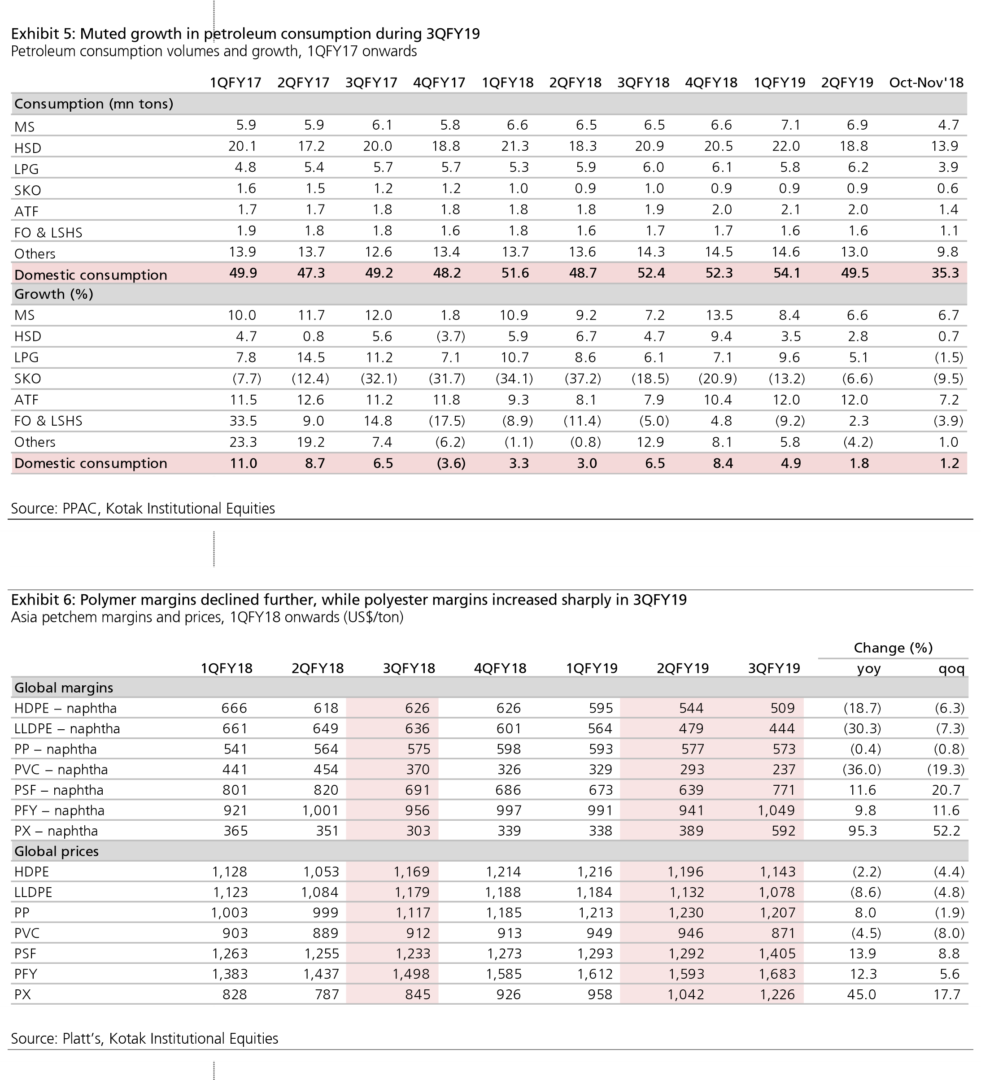

We expect RIL to report stable standalone net income at `88.9 bn (EPS of `13.7), as lower refining margins will be mitigated by (1) higher polyester margins, (2) a weaker Rupee, (3) forex gains versus loss in the past two quarters and (4) higher other income. We estimate refining margins to decline to US$7/bbl from US$9.5/bbl in 2QFY19, led by (1) sharp fall in spreads for gasoline and naphtha, (2) increase in fuel oil spreads, a negative for RIL, and (3) lower lightheavy crude differentials; we highlight that RIL’s hedging policies may prevent large adventitious loss, like OMCs. We model RIL’s consolidated net income to increase 1% qoq to `96.3 bn (EPS of `16.2) in 3QFY19, led by an increase in Jio’s net income to `9.5 bn from `6.8 bn in 2QFY19. OMCs: strength in underlying margins and forex gains will be negated by large inventory loss.

We expect downstream PSUs to report dismal results in 3QFY19 led by significant adventitious/ inventory loss due to a rather sharp US$30/bbl fall in end-period crude (and product) prices, similar to 3QFY15. However, we expect these companies to report US$1-1.5/bbl qoq increase in underlying refining margins, contrary to US$1.7/bbl fall in Singapore complex margins, due to (1) lagged impact of fall in product prices due to fortnightly/monthly revision in RTPs of key products, (2) higher spreads on fuel oil and (3) healthy spreads for middle distillates, which constitutes a larger proportion of product mix. Underlying marketing margins were steady for diesel at `2.6/liter and higher for gasoline at `3/liter (+`1/liter qoq). We expect BPCL, HPCL and IOCL to report net loss of `3.1 bn, `1.5 bn and `37.3 bn in 3QFY19, accounting adventitious/ inventory loss of `37 bn, `29 bn and `127 bn. We expect Castrol to report 5% yoy decline in EPS to `1.9, led by a sharp 430 bps contraction in EBITDA margins amid higher RM costs.

Upstream: steady EBITDA qoq as weaker rupee and higher gas price will offset lower oil price

We expect OIL and ONGC to report sequentially steady EBITDA as (1) 10% increase in domestic gas price, (2) a weaker Rupee against US Dollar and (3) reversal of forex loss, will be offset by lower net crude realization reflecting US$8/bbl fall in global oil prices. We expect ONGC’s net income to decline 7% qoq to `76.9 bn (EPS of `6) in 3QFY19, driven by (1) lower other income despite dividends received from IOCL, (2) higher interest cost and (3) higher DD&A expenses. We expect OIL’s net income to jump 15% qoq to `9.9 bn (EPS of `8.2) due to large dividends received from IOCL, which will be partially offset by higher DD&A expenses.

Gas sector: weaker results from GAIL/PLNG; expansion in unit margins to boost CGDs

We expect GAIL to report sharp 21% qoq decline in adjusted net income to `15.3 bn (EPS of6.8), led by (1) sharp fall in gas marketing contribution due to weaker economics of the US LNG volumes and (2) lower petchem profits amid planned shutdown, which will be offset by higher profits on LPG/LHC production; transmission volumes may remain stable at 106 mcm/d in line with steady gas consumption. We expect 8% qoq decline in PLNG’s net income to `5.3 bn (EPS of `3.5), led by (1) 2% qoq decline in volumes amid lower LNG imports and (2) higher fuel consumption during winters. We expect IGL and MGL to report robust 14-16% yoy increase in EBITDA, despite slower 7-8% growth in volumes amid intermittent strikes by fleet cabs, reflecting moderate expansion of unit margins based on price hikes undertaken in 3QFY19. We expect GSPL to report qoq stable EBITDA amid steady volumes and tariffs.